Which of the following is true of retirement plans? This question delves into the intricacies of retirement planning, a crucial aspect of financial security. Retirement plans offer a multitude of benefits, ranging from tax advantages to investment options. Understanding the different types of retirement plans and their implications is essential for making informed decisions that will secure your financial future.

This comprehensive guide will provide a thorough overview of retirement plans, covering eligibility requirements, contribution limits, investment options, and distribution rules. We will also explore the role of retirement plans in estate planning and the benefits of employer-sponsored plans and IRAs.

By the end of this discussion, you will have a clear understanding of which retirement plan is right for you and how to maximize its benefits.

Overview of Retirement Plans

Retirement plans are financial accounts designed to help individuals save and invest for their retirement years. They offer numerous benefits, including:

- Tax deductions or deferrals on contributions, reducing current income tax liability.

- Tax-free growth of investments within the account, allowing earnings to accumulate faster.

- A steady source of income during retirement, ensuring financial security.

There are various types of retirement plans available, each with its own features and benefits:

-

-*Employer-sponsored plans

These plans are offered by employers to their employees and include options such as 401(k)s and 403(b)s.

-*Individual Retirement Accounts (IRAs)

These accounts are opened by individuals directly with financial institutions, such as banks or brokerages.

Tax Advantages of Retirement Plans

Retirement plans offer significant tax advantages that encourage individuals to save for retirement:

-

-*Tax deductions or deferrals

Contributions to many retirement plans, such as 401(k)s and traditional IRAs, are tax-deductible, meaning they reduce your current income tax liability.

-*Tax-free growth

Earnings on investments within retirement accounts grow tax-free until they are withdrawn in retirement. This allows your savings to accumulate faster and reach a higher value over time.

Eligibility and Contribution Limits

Eligibility for retirement plans varies depending on the type of plan:

-

-*Employer-sponsored plans

Eligibility is typically based on factors such as employment status and age.

-*IRAs

Most individuals are eligible to contribute to IRAs, but there are income limits for full deductibility.

Contribution limits also vary depending on the plan type and year:

-

-*401(k)s

The annual contribution limit for 2023 is $22,500 ($30,000 for those age 50 and older).

-*IRAs

The annual contribution limit for 2023 is $6,500 ($7,500 for those age 50 and older).

Investment Options Within Retirement Plans

Retirement plans offer a wide range of investment options to meet different risk tolerances and financial goals:

-

-*Mutual funds

These funds invest in a diversified portfolio of stocks, bonds, or other assets.

-*Target-date funds

These funds automatically adjust their asset allocation based on your target retirement date.

-*Exchange-traded funds (ETFs)

These funds track the performance of a specific index or sector.

-*Stocks

These represent ownership shares in companies and can provide potential for growth.

-*Bonds

These represent loans to companies or governments and provide fixed income payments.

Distribution Rules and Taxes

When you take money out of a retirement account, it is considered a distribution and may be subject to taxes and penalties:

-

-*Required minimum distributions (RMDs)

Starting at age 72, you must take minimum annual distributions from your retirement accounts.

-*Taxes

Distributions from traditional retirement accounts are taxed as ordinary income. Distributions from Roth accounts are tax-free if certain conditions are met.

-*Penalties

Early withdrawals from retirement accounts before age 59½ may be subject to a 10% penalty tax.

Estate Planning Considerations: Which Of The Following Is True Of Retirement Plans

Retirement plans can play a role in estate planning:

-

-*Designation of beneficiaries

You can designate beneficiaries to inherit your retirement account upon your death.

-*Minimizing estate taxes

Retirement accounts can be used to reduce the value of your taxable estate and minimize estate taxes.

Employer-Sponsored Retirement Plans

Employer-sponsored retirement plans, such as 401(k)s and 403(b)s, offer several benefits:

-

-*Employer contributions

Many employers match a portion of employee contributions, providing additional savings.

-*Higher contribution limits

Employer-sponsored plans often have higher annual contribution limits than IRAs.

-*Automatic enrollment

Some plans automatically enroll employees, making it easy to start saving for retirement.

Individual Retirement Accounts (IRAs)

IRAs are retirement accounts that individuals can open and manage on their own:

-

-*Traditional IRAs

Contributions are tax-deductible, but distributions are taxed as ordinary income.

-*Roth IRAs

Contributions are made after-tax, but distributions are tax-free if certain conditions are met.

-*Eligibility

Most individuals are eligible to contribute to IRAs, but there are income limits for full deductibility.

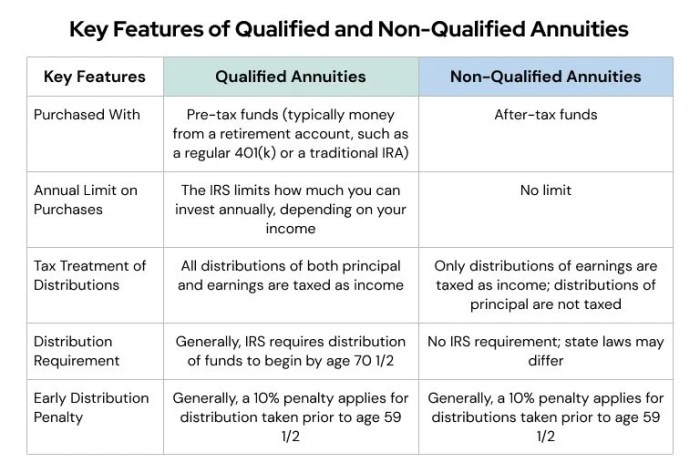

Comparing Retirement Plans

The table below compares key features of different types of retirement plans:| Feature | 401(k) | 403(b) | Traditional IRA | Roth IRA ||—|—|—|—|—|| Employer-sponsored | Yes | Yes | No | No || Employer contributions | Yes | Yes | No | No || Contribution limits | $22,500 ($30,000 for age 50+) | $22,500 ($30,000 for age 50+) | $6,500 ($7,500 for age 50+) | $6,500 ($7,500 for age 50+) || Tax deductions | Yes | Yes | Yes | No || Tax-free growth | Yes | Yes | Yes | Yes || RMDs | Yes | Yes | Yes | No || Early withdrawal penalties | Yes | Yes | Yes | Yes |

Additional Considerations

When planning for retirement, consider these additional factors:

-

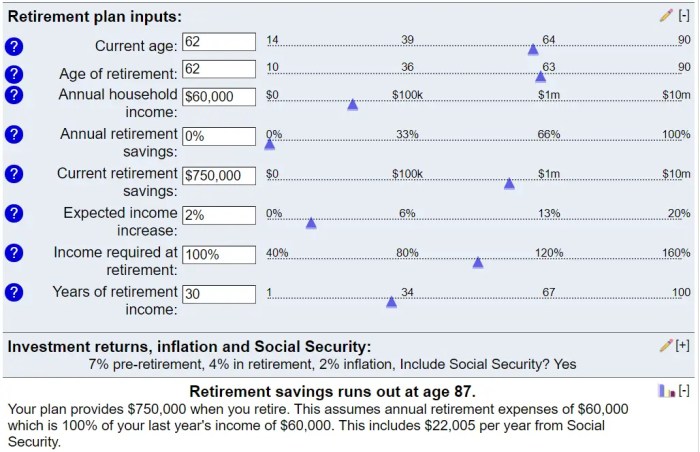

-*Social Security benefits

Social Security provides a monthly income during retirement.

-*Health insurance

Health care costs can be a significant expense in retirement.

-*Estate planning

Retirement plans can be used to reduce estate taxes and pass on assets to heirs.

-*Seek professional advice

Consult with a financial advisor or tax professional to develop a personalized retirement plan.

Essential FAQs

What is the purpose of a retirement plan?

Retirement plans are designed to provide financial security during retirement by allowing individuals to save and invest money on a tax-advantaged basis.

What are the different types of retirement plans?

There are various types of retirement plans available, including employer-sponsored plans (e.g., 401(k), 403(b)) and individual retirement accounts (IRAs). Each type has its own eligibility requirements, contribution limits, and investment options.

What are the tax advantages of retirement plans?

Retirement plans offer tax advantages, such as tax deductions for contributions and tax-free growth of investments within the account. Distributions in retirement may be taxed at a lower rate, depending on the type of plan.

How do I choose the right retirement plan for me?

Choosing the right retirement plan depends on your individual circumstances, including your income, age, and risk tolerance. Consider factors such as eligibility requirements, contribution limits, investment options, and fees.