The savings account offering which of these aprs – With the savings account offering a range of APRs, it’s crucial to understand how they impact your savings goals. This article delves into the factors to consider when comparing APRs, providing a comprehensive guide to maximizing your savings potential.

By exploring the influence of interest compounding frequency, fixed and variable APRs, and additional fees, we empower you to make informed decisions about your savings account.

Savings Account APRs: A Comparative Guide: The Savings Account Offering Which Of These Aprs

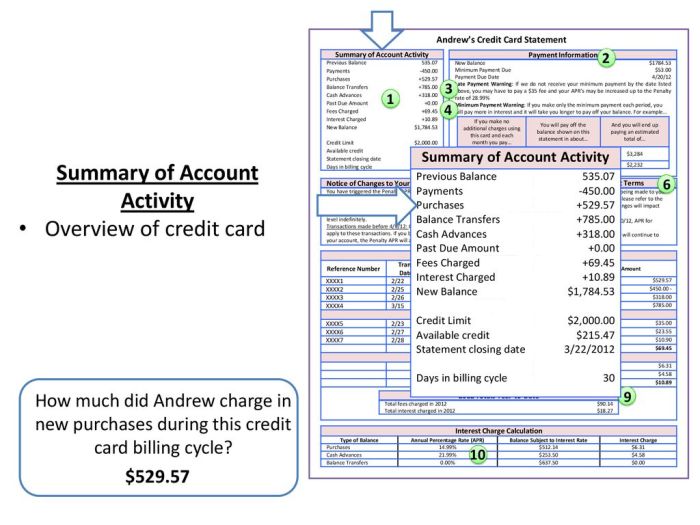

Savings accounts are an essential financial tool for managing finances, providing a safe and accessible place to store funds while earning interest. The annual percentage rate (APR) is a key factor to consider when choosing a savings account, as it determines the amount of interest earned on your deposits.

Comparing APRs allows you to identify the most lucrative savings accounts and maximize your earnings. Here’s a comprehensive guide to understanding APRs and comparing them effectively.

Factors to Consider When Comparing APRs

Several factors influence the APRs offered by different savings accounts:

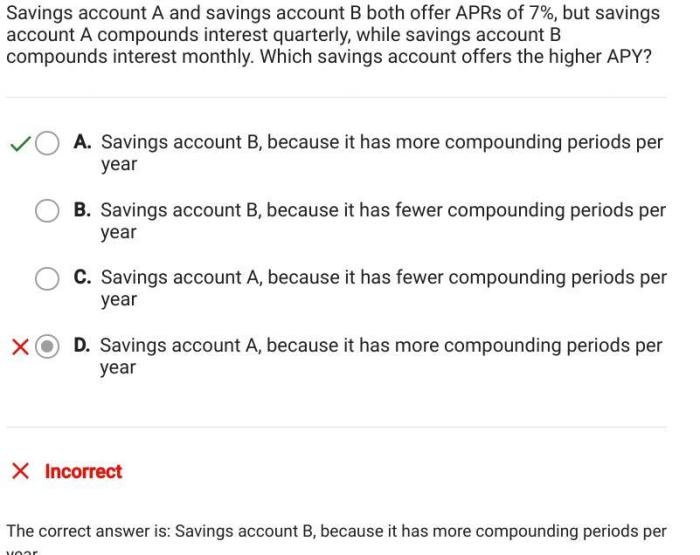

- Interest Compounding Frequency:The frequency at which interest is compounded (daily, monthly, quarterly, or annually) affects the overall APR.

- Fixed vs. Variable APRs:Fixed APRs remain constant throughout the account’s term, while variable APRs fluctuate with market conditions.

- Fees and Minimum Balance Requirements:Some savings accounts charge maintenance fees or require minimum balance levels, which can reduce your net earnings.

Methods for Comparing APRs

To compare APRs effectively, follow these steps:

- Use Online Comparison Tools:Online platforms allow you to compare APRs from multiple banks and credit unions simultaneously.

- Calculate Effective Annual Yield (EAY):EAY considers the compounding frequency to provide a more accurate comparison of APRs.

- Create a Comparison Table:Organize the APRs, EAYs, fees, and minimum balance requirements of different accounts in a table for easy reference.

Impact of APRs on Savings Goals, The savings account offering which of these aprs

APRs play a crucial role in achieving savings goals:

- Growth of Savings:Higher APRs lead to faster growth of savings over time.

- Goal Achievement:Choosing a savings account with a higher APR can shorten the time it takes to reach financial goals.

Tips for Maximizing APR Impact:

- Choose a savings account with a competitive APR.

- Consider accounts with frequent interest compounding.

- Avoid accounts with high fees or minimum balance requirements.

- Monitor APRs regularly and switch accounts if necessary.

FAQ Insights

What is the impact of interest compounding frequency on APRs?

Interest compounding frequency refers to how often the interest earned on your savings is added to your principal balance. More frequent compounding results in higher effective APRs.

How do fixed and variable APRs differ?

Fixed APRs remain constant throughout the life of the savings account, while variable APRs can fluctuate based on market conditions.

Why is it important to consider fees and minimum balance requirements?

Fees and minimum balance requirements can reduce the effective APR of your savings account. It’s crucial to factor in these costs when comparing APRs.